As we know, living out of home can be tough. You’ve got rent to pay, bills to pay, groceries, chores, food, cleaning, maintenance costs, fix things if they break – the list can go on. Not all of these can be bad, as that’s why flatmates exist. You can do these things together. However, one of the biggest issues when it comes to renting is splitting the cost between all parties fairly and paying the bills on time.

There are many direct and individual consequences when it comes to not paying bills on time. It can result in a bad credit score, hence, down the track when you have the choice if taking out a loan or mortgage, this can be much more difficult to achieve.

There’s no reason to panic. All that is required is some clear organisation and expectations by all parties involved to keep a harmonious household.

1. Work out how you will share your bills

When starting out a new tenancy, you need to have specify some ground rules and go through a checklist of things that need to be sorted when sharing/splitting the bills.

- Rent

- Gas + Electricity

- Water

- TV

- Internet

- Council Tax

- Other miscellaneous stuff (i.e. interior updates, decorations, etc).

Now, some of these pay be already covered as part of the deal with the landlord. Different situations and agreements have different circumstances, hence your situation by be different from someone else’s.

Take action when moving in or bringing in new flatmates, that there is a checklist similar to the items above and clear expectations are agreed with everyone.

If you want, you could even be a bit more formal by creating a spreadsheet with predicting future payments and learn how to allocate funds to cover these costs.

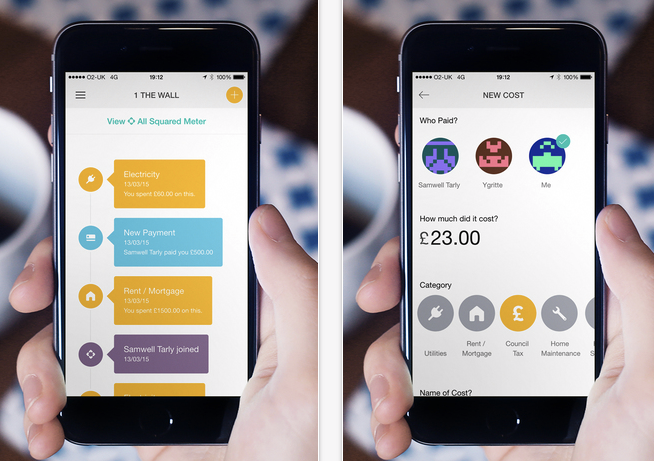

2. Use Splittable for distributing fair expenses

It can be a hassle when it comes to organising who pays what and when. Splittable is an app that takes away the stress around payment for various bills and expenses, and keeps track of what needs to be paid and by whom.

What’s great about Splittable as well, is that it split the rent fairly according to the room size for yourself and your flatmates. For example, if your flatmate is living in the master bedroom ensuite, and you’re living in a small bedroom, it’s only fair that your roommate pays more of the rent.

3. Set up a ‘Kitty’ for the essentials

If you’re not too sure what a ‘kitty’ is, a kitty is like a money jar, where roommates pay for shared small expenses such as food, bills (electricity, internet, etc), or anything to do with basics around the apartment with small spare change.

A good idea is that everytime you have a spare $2 from a night-out, put it in the money jar. Another example is making sure everyone puts in $10 a week at the end of their work week (or after they receive their pay cheque), and put the small money into the jar and watch it add up.

This ‘Kitty’ solution is only applicable when you really trust your flatmates (or have known them for long time). One disadvantage for this idea is that it may not be completely even with everyone contributing the exact same amount, but it will be pretty close. I do this with my flatmates.

4. Interior decorating

This is more applicable to moving in with your flatmates at first, but designing and purchasing items for your apartment can become relatively expensive without control (I’m guilty of this). What can be difficult when sharing the costs for decorations and buying items is who really spends more time using it, preferences for design, etc. For example, buying a TV could cost you $1000, yet if only one of you uses the TV much more than the other roommate, then it’s only fair that the roommate who watches more TV should pay a bigger portion of the $1000.

Although the TV situation does cover nice additions to the apartment, splitting costs halfway for necessities such as Kitchen appliances, furniture, bathroom accessories, and other important items, is much easier and halving the costs from both ends is a safe solution.

There isn’t a simple solution overall to splitting costs for interior decorating and purchasing items, as it will simply come down to case by case basis. Common sense will prevail.

5. Social activities

This again comes down to case by case basis with your flatmates. Lets say you’re planning a trip up the coast from Sydney to Byron Bay, or a week trip to Vegas with the boys, or as simple as a Sunday afternoon drinks session with your girlfriends, figuring out who pays for what like petrol, food, dinners, hotel rooms, groceries, etc. can be annoying when consulting with your roommates (this happens to me all the time).

Solution? Luckily, Splittable is a great option to help split costs, or there are other apps which could help out too. Or, simply printing receipts and splitting the costs evenly is also the best way to go as well.